In the fast-paced world of financial markets, where opportunities and risks coexist, traders are constantly seeking strategies that provide an edge. One such strategy that has garnered significant attention is the NASDAQ Daily Breakout Trading System. Designed to exploit price volatility and capitalize on emerging trends, this system focuses on trading breakouts in the NASDAQ stock market, a global epicenter for technology and innovation. Stocks are the most profitable assets to trade because they have a strong inbuilt long bias. Most volatile yet sufficient liquid stocks represent an opportunity to generate Alpha. A breakout system is able to capture big chunks of stocks growth and volatility while having a larger average trade and so minimizing the transaction and the implicit market costs.

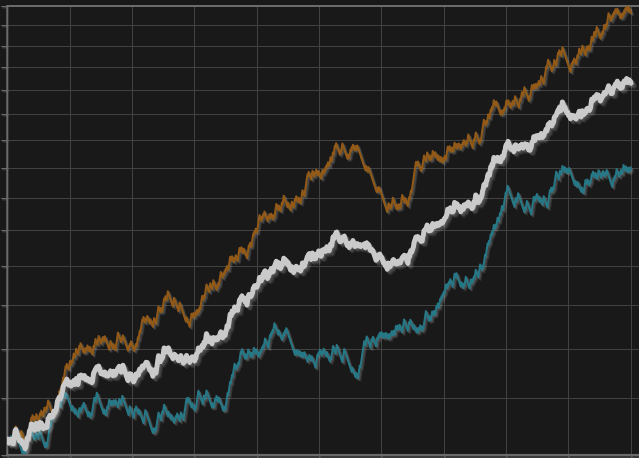

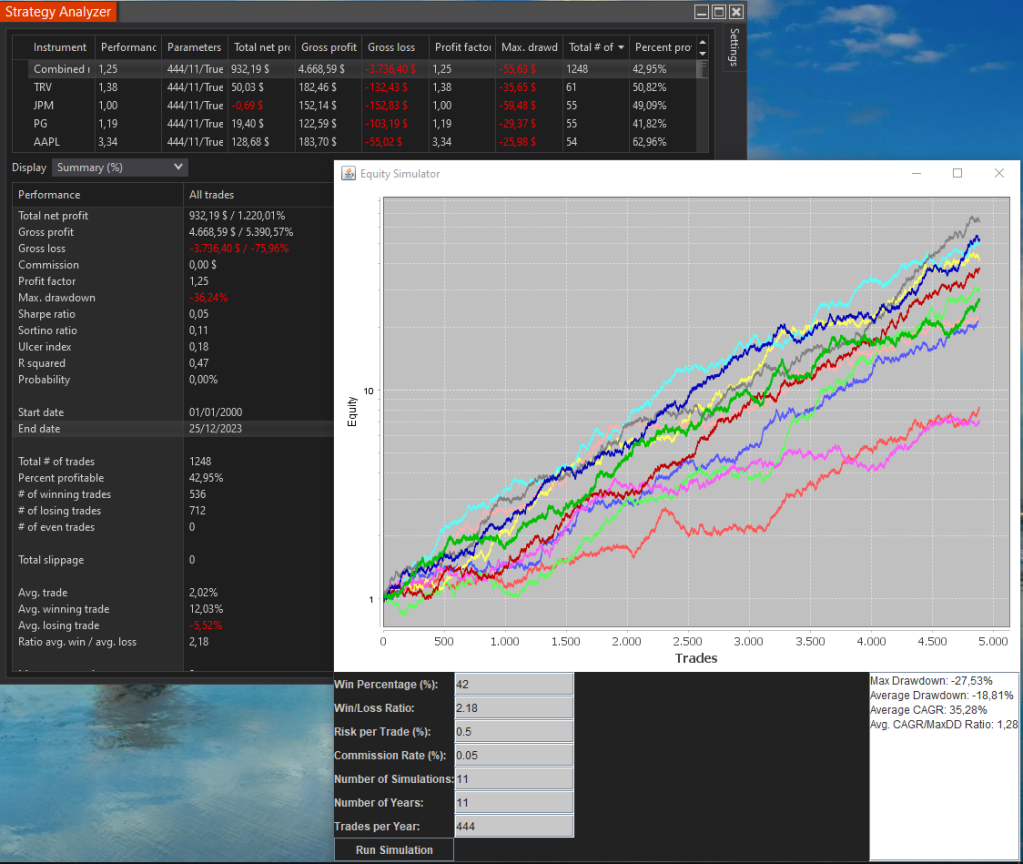

Here is a forecast of the strategy outcome using an appropriate position sizing.

The NASDAQ Daily Breakout Trading System is a disciplined approach that leverages price movements within the daily chart of NASDAQ-listed stocks. It offers traders the potential for substantial profits by identifying and participating in the early stages of price movements that often result from significant news events, earnings reports, or shifts in market sentiment.

This trading system is grounded in technical analysis, particularly in the analysis of historical price data and chart patterns. Traders employing this approach scrutinize daily price charts to identify specific breakout points, which are critical junctures where the price of a security moves beyond a defined range or technical level. By strategically entering trades at these breakout points, traders aim to profit from the subsequent price momentum and ride the trend until it shows signs of exhaustion.

Key components of the NASDAQ Daily Breakout Trading System include:

- Technical Analysis: Traders use a variety of technical indicators and chart patterns to identify potential breakouts. These indicators may include moving averages, Bollinger Bands, and Relative Strength Index (RSI), among others.

- Risk Management: Risk is carefully managed through position sizing, stop-loss orders, and profit-taking strategies. This system places a strong emphasis on capital preservation.

- Time Frame: The system operates on the daily chart, allowing traders to make informed decisions based on the daily price action and reduce the impact of intraday noise.

- Volatility Awareness: NASDAQ stocks are known for their volatility, and this system takes this into account by adjusting position sizes and risk levels based on market conditions.

- Continuous Learning: Successful implementation of this trading system requires ongoing learning and adaptation. Traders must stay informed about market news, earnings announcements, and macroeconomic events that could impact their trades.