In the dynamic world of financial markets, small retail traders often find themselves navigating a landscape dominated by institutional players and seasoned professionals. However, armed with the right strategies and tools, small traders can level the playing field and even thrive in this competitive environment. One such approach involves targeting high reward-to-risk trades, implementing breakout strategies, and employing Monte Carlo analysis for meticulous risk management. In this comprehensive guide, we delve into the advantages of these techniques and how they can be combined to optimize trading performance for small retail traders.

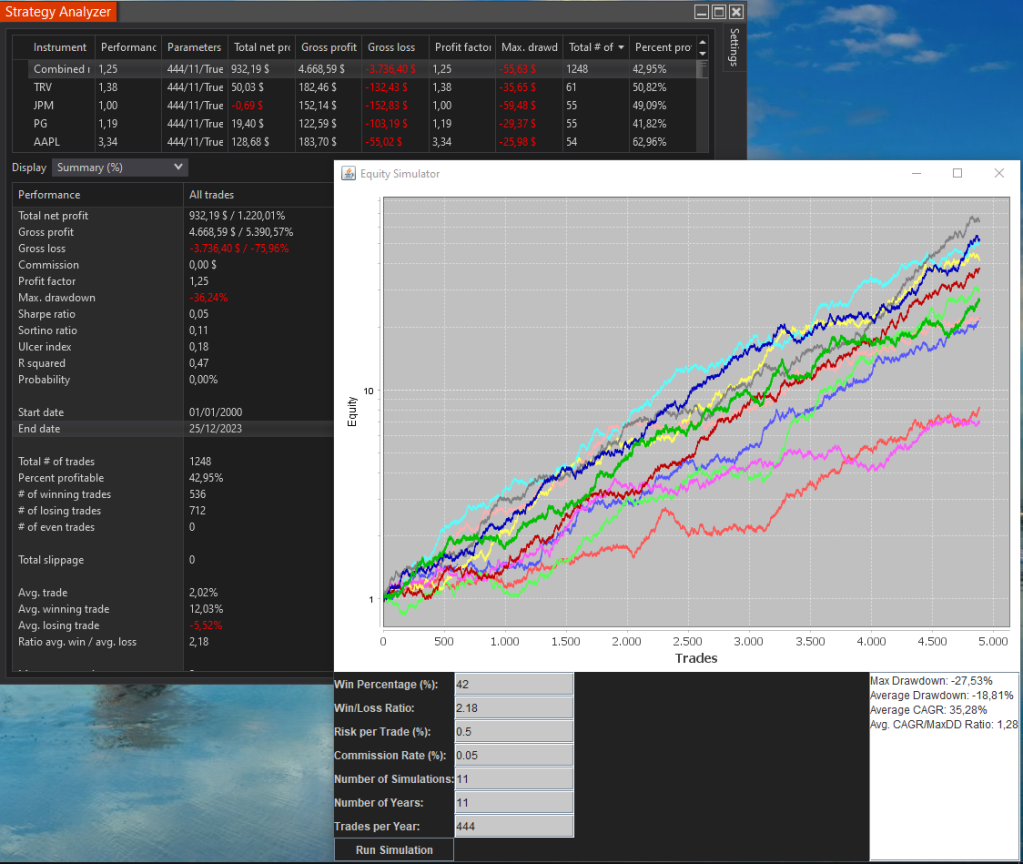

Check out or free equity curve simulator and montecarlo analysis tool.

Advantages of High Reward-to-Risk Trades:

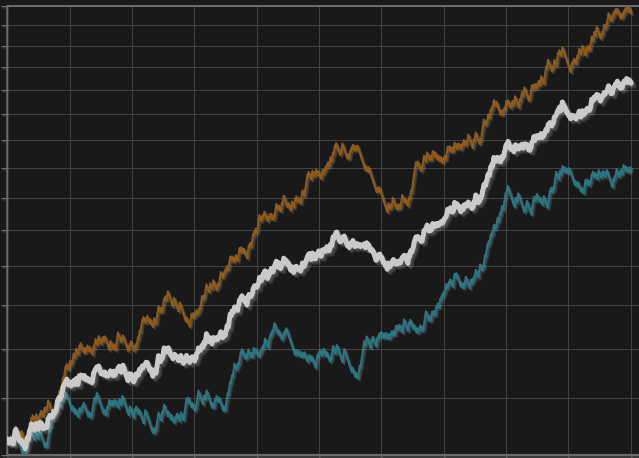

High reward-to-risk trades form the cornerstone of a successful trading strategy for small retail traders. Unlike institutional investors who may focus on volume and liquidity, small traders can capitalize on opportunities that offer asymmetric risk-reward profiles. By targeting trades with a high potential reward relative to the risk undertaken, traders can effectively amplify their gains while limiting their exposure to losses. This approach allows for the cultivation of a favorable risk-reward ratio, which is crucial for long-term profitability.

Breakout Strategies:

Breakout strategies involve identifying key levels of support and resistance and trading the subsequent price movements when these levels are breached. For small retail traders, breakout strategies offer several advantages:

- Volatility Exploitation: Breakouts often occur during periods of heightened volatility, providing traders with ample opportunities to capitalize on significant price movements.

- Clear Entry and Exit Points: Breakout levels serve as clear entry and exit points, allowing traders to define their risk and reward parameters with precision.

- Trend Riding: Successful breakouts often signal the emergence of new trends, enabling traders to ride the momentum and capture substantial profits.

By mastering breakout strategies, small traders can effectively identify and capitalize on market opportunities, leading to enhanced profitability and consistency in their trading endeavors.

Risk Management with Monte Carlo Analysis:

While high reward-to-risk trades and breakout strategies offer the potential for substantial gains, effective risk management is paramount to safeguarding capital and preserving long-term viability. Monte Carlo analysis provides a sophisticated yet accessible method for assessing and mitigating risk.

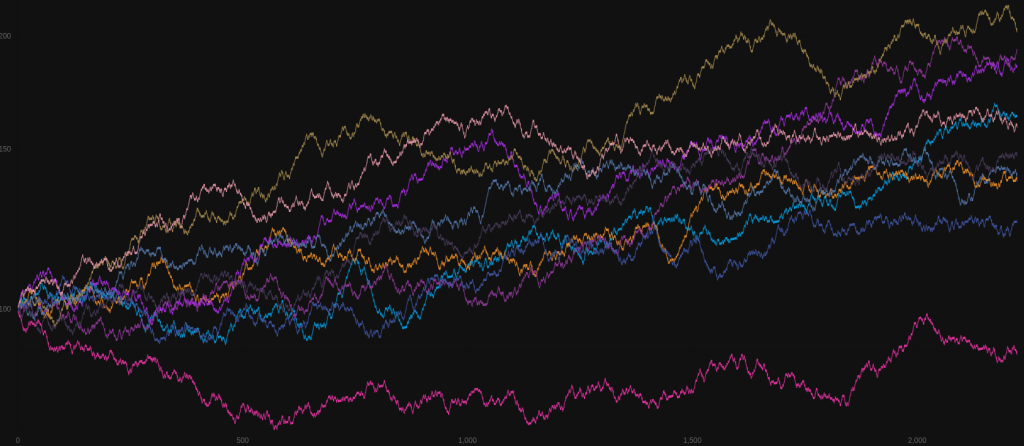

Monte Carlo analysis involves simulating thousands of potential future scenarios based on historical data and the trader’s specified parameters. By incorporating variables such as win rate, reward-to-risk ratio, and position size, traders can gain insights into the probability of different outcomes and adjust their strategies accordingly.

Key steps in utilizing Monte Carlo analysis for risk management include:

- Determining Risk Tolerance: Define the maximum acceptable drawdown and overall risk tolerance based on personal financial goals and risk appetite.

- Establishing Correct Risk Size: Calculate the optimal position size for each trade based on the desired risk-to-reward ratio and the size of the trading account.

- Iterative Optimization: Continuously refine trading parameters based on Monte Carlo simulations to adapt to changing market conditions and improve overall performance.

By integrating Monte Carlo analysis into their risk management framework, small traders can make informed decisions, minimize downside risk, and maximize the probability of achieving their trading objectives.

Conclusion:

In conclusion, small retail traders can gain a competitive edge in the financial markets by focusing on high reward-to-risk trades, implementing breakout strategies, and employing Monte Carlo analysis for effective risk management. By targeting trades with favorable risk-reward ratios, capitalizing on breakout opportunities, and utilizing sophisticated risk assessment techniques, small traders can optimize their trading performance and increase their chances of long-term success. While navigating the complexities of the market may seem daunting, armed with the right strategies and tools, small traders can chart a path towards profitability and financial independence.