In the realm of financial planning and investment, uncertainty is an ever-present companion. Market volatility, economic shifts, and unforeseen events can all impact the performance of investment portfolios. To navigate this uncertainty effectively, professionals often turn to sophisticated tools like Monte Carlo analysis and equity curve simulation. These techniques offer valuable insights into the range of possible outcomes and help investors make informed decisions to achieve their financial goals.

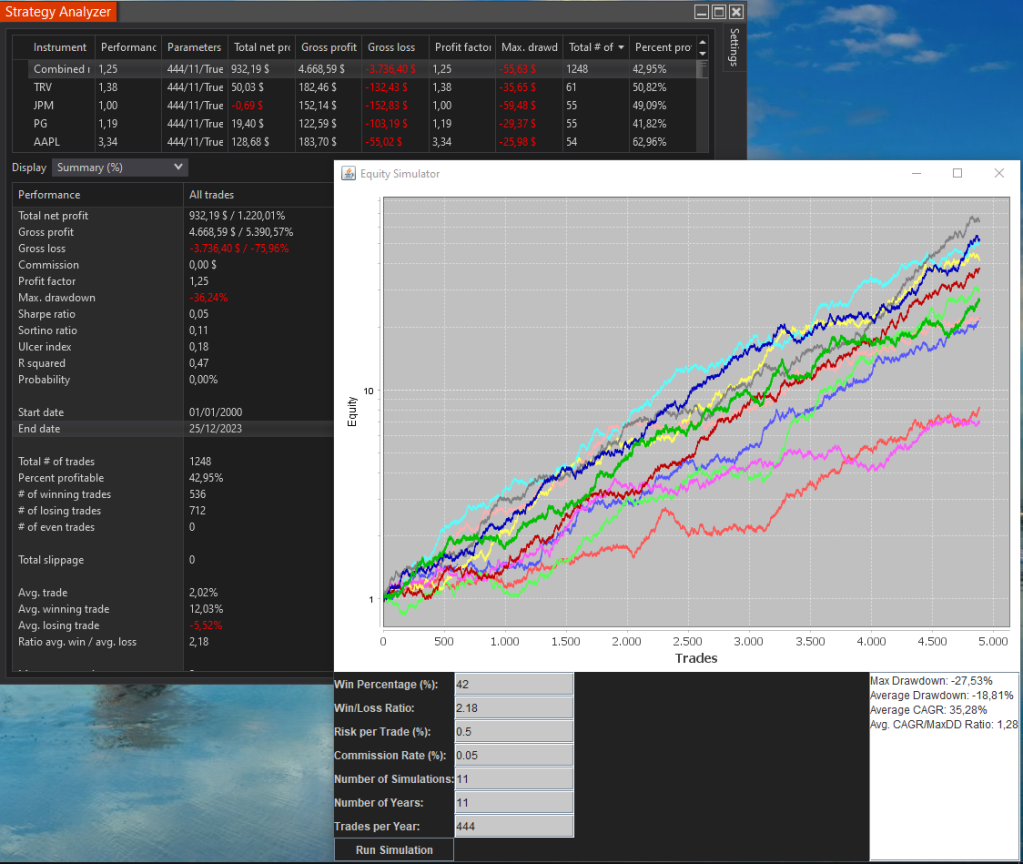

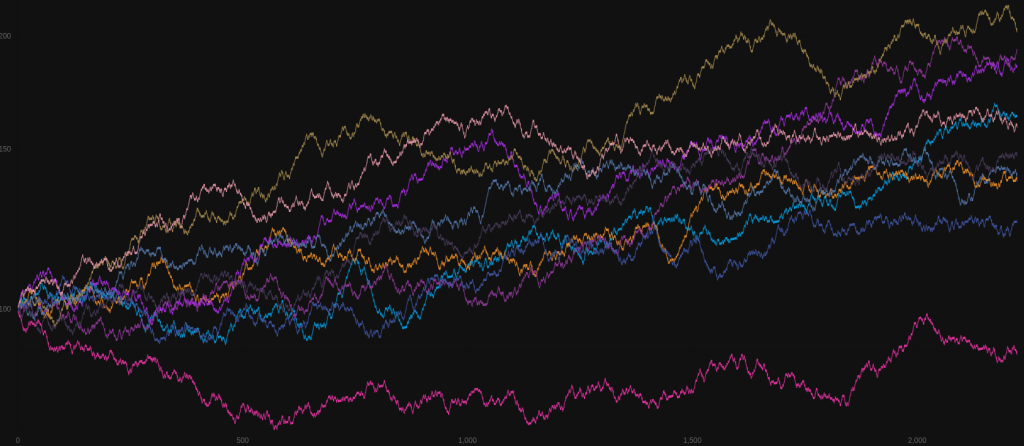

Monte Carlo analysis is a powerful statistical method used to model the probability of different outcomes in a process that involves random variables. In financial planning, Monte Carlo simulations are employed to assess the potential performance of investment portfolios under various market scenarios. By running thousands of simulations based on historical data and assumptions about future market behavior, Monte Carlo analysis generates a distribution of possible outcomes, providing investors with a clearer understanding of the risks and opportunities associated with their investments.

[ Launch the Equity Curve Simulator Tool ]

One of the key benefits of Monte Carlo analysis is its ability to account for uncertainty and variability in financial markets. Traditional deterministic models often fail to capture the full range of possible outcomes, leading to overly optimistic or pessimistic projections. Monte Carlo simulations, on the other hand, take into account the inherent randomness of market fluctuations, allowing investors to assess the likelihood of achieving their financial objectives under different conditions.

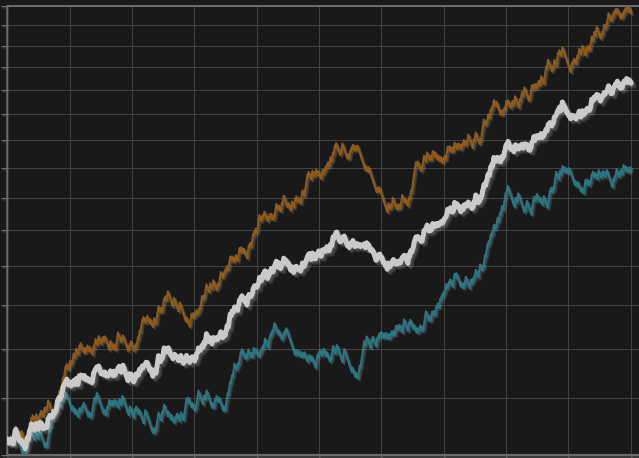

Equity curve simulation, another essential tool in financial planning, focuses on analyzing the performance of investment portfolios over time. This technique involves plotting the equity curve, which represents the cumulative value of the portfolio as it evolves with each investment decision and market fluctuation. By simulating various scenarios and adjusting parameters such as asset allocation, risk tolerance, and investment strategy, equity curve simulation enables investors to visualize how different factors impact the long-term growth and stability of their portfolios.

One of the primary implications of Monte Carlo analysis and equity curve simulation is their role in risk management. By providing a comprehensive view of the potential outcomes and performance trajectories of investment portfolios, these techniques empower investors to make more informed decisions and implement strategies to mitigate risk. Whether it’s adjusting asset allocation, diversifying investments, or incorporating hedging strategies, Monte Carlo analysis and equity curve simulation serve as invaluable tools for optimizing portfolio performance while minimizing downside risk.

Moreover, these techniques also facilitate effective communication between financial advisors and their clients. By presenting visualizations and probability distributions that illustrate the range of possible outcomes, advisors can help clients set realistic expectations and develop investment strategies aligned with their financial goals and risk tolerance. This transparency and clarity enhance trust and confidence in the financial planning process, fostering a collaborative relationship between advisors and their clients.

In conclusion, Monte Carlo analysis and equity curve simulation are essential tools in the toolkit of modern financial planning. By harnessing the power of statistical modeling and simulation, these techniques enable investors to navigate the complexities of financial markets with greater confidence and clarity. By embracing uncertainty and incorporating probabilistic analysis into their decision-making process, investors can better manage risk, optimize portfolio performance, and ultimately achieve their long-term financial objectives.