The Connors RSI2 strategy is a popular and well-known trading strategy developed by Larry Connors. It is designed to identify short-term overbought or oversold conditions in a market and exploit potential mean-reversion opportunities. The strategy incorporates elements of the Relative Strength Index (RSI) and uses a short-term trading approach. Here’s an overview of the Connors RSI2 strategy:

Components and Methodology:

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is commonly used to identify overbought (typically above 70) and oversold (typically below 30) conditions.

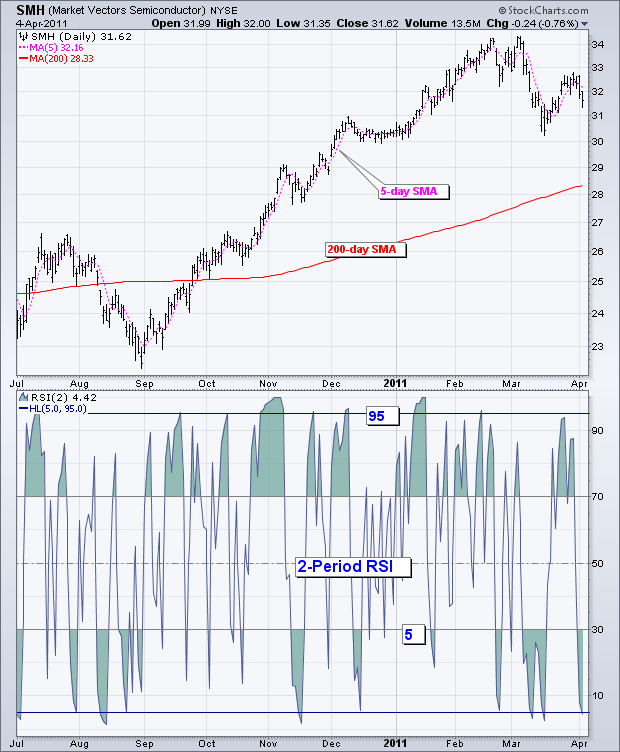

- RSI2 Calculation: The Connors RSI2 strategy focuses on a short-term RSI calculation using a 2-period setting. This means that the RSI is calculated based on the price changes over the most recent two periods (typically days for daily charts).

- Thresholds: The Connors RSI2 strategy uses different overbought and oversold thresholds compared to the traditional RSI. It considers readings below 10 as potential buy signals and readings above 90 as potential sell signals.

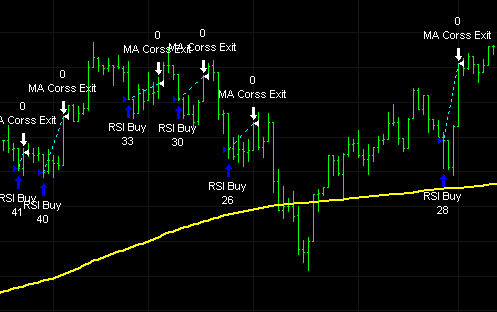

- Buy Signal: A buy signal is generated when the Connors RSI2 value drops below the oversold threshold of 10 and then crosses back above it. This implies that the security may have been oversold and could experience a short-term bounce.

- Sell Signal: A sell signal is generated when the Connors RSI2 value rises above the overbought threshold of 90 and then crosses back below it. This suggests that the security might have been overbought and could experience a short-term pullback.

Advantages:

- Short-Term Focus: The strategy is designed for short-term trading and aims to capitalize on mean-reversion opportunities over a brief period.

- Quantitative Approach: The specific threshold levels provide clear and objective buy and sell signals.

- Contrarian Strategy: It seeks to capitalize on market extremes and short-term reversals, making it a contrarian approach.

Considerations:

- Whipsaws: Due to its short-term nature, the strategy may result in false signals or whipsaws during periods of strong trending markets.

- Risk Management: Effective risk management is crucial to prevent losses during adverse market conditions.

- Confirmation: It’s advisable to use additional technical or fundamental analysis to confirm signals before executing trades.

Conclusion:

The Connors RSI2 strategy is a simple yet effective short-term trading approach that combines the principles of the RSI with specific threshold levels. It’s important for traders to understand the strategy’s mechanics, test it rigorously using historical data, and tailor it to their risk tolerance and trading style before considering its implementation.